Irmaa Limits 2024

Irmaa Limits 2024. For example, you would qualify for irmaa in 2024 if your magi from your 2022 tax returns meets the 2024 income thresholds ($103,000 for. The calculation is a tiered system where the amount of the premium increase depends on the individual’s income level.

The irmaa income brackets for 2023 start at $97,000 ($103,000 in 2024) for a single person and $194,000 ($206,000 in 2024) for a married couple. The surcharge is called irmaa, which stands for.

2024 Irmaa Brackets Will Be Worse Than Irmaa 2023 And Going Forward Irmaa Will Simply Become More And More Of A Problem For Retirees.

Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d premiums.

The Surcharge Is Called Irmaa, Which Stands For.

On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2024 premiums, deductibles, and coinsurance amounts for the medicare.

The Centers For Medicare Services ( Cms) Is Announcing The 2024 Irmaa.

Images References :

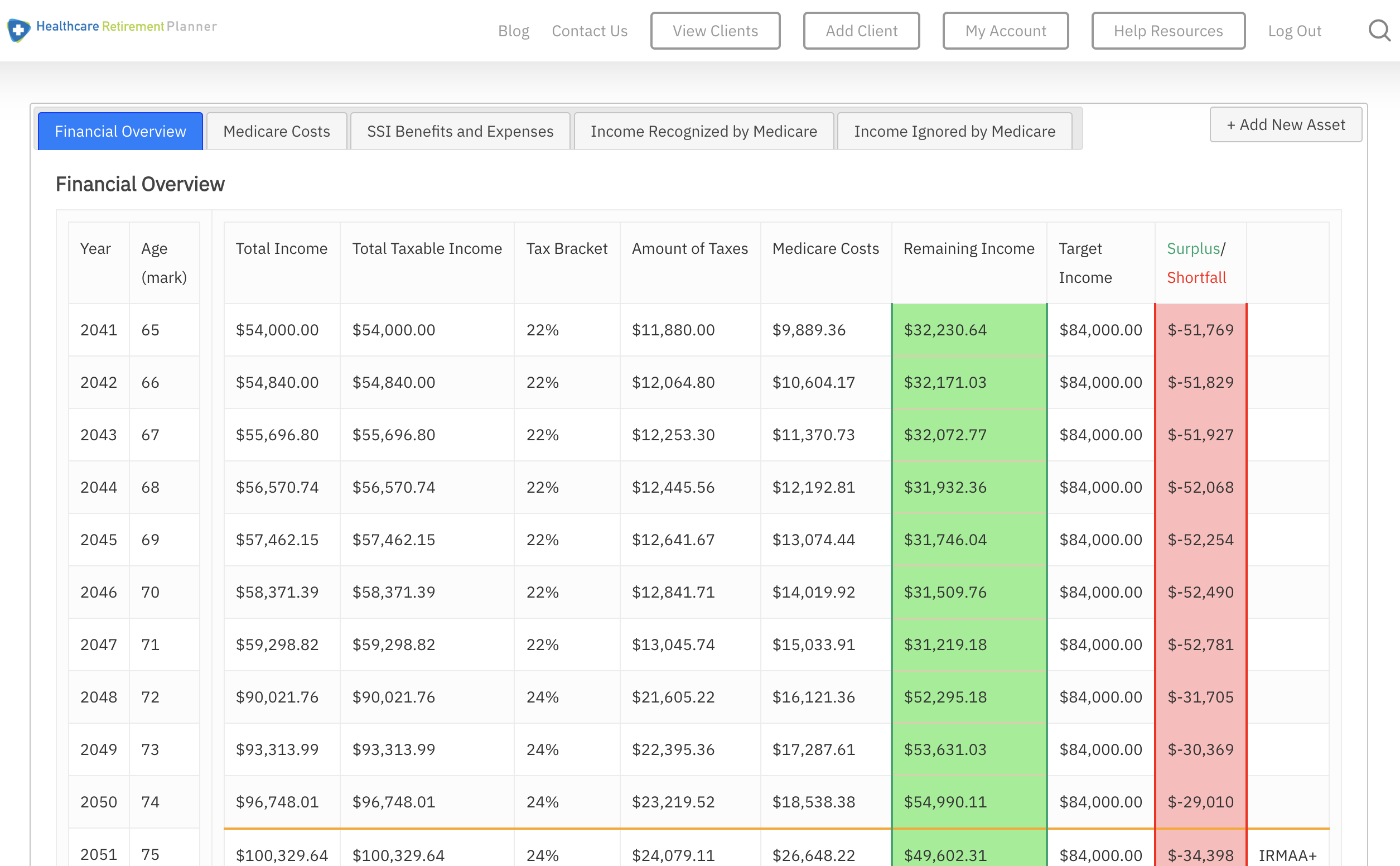

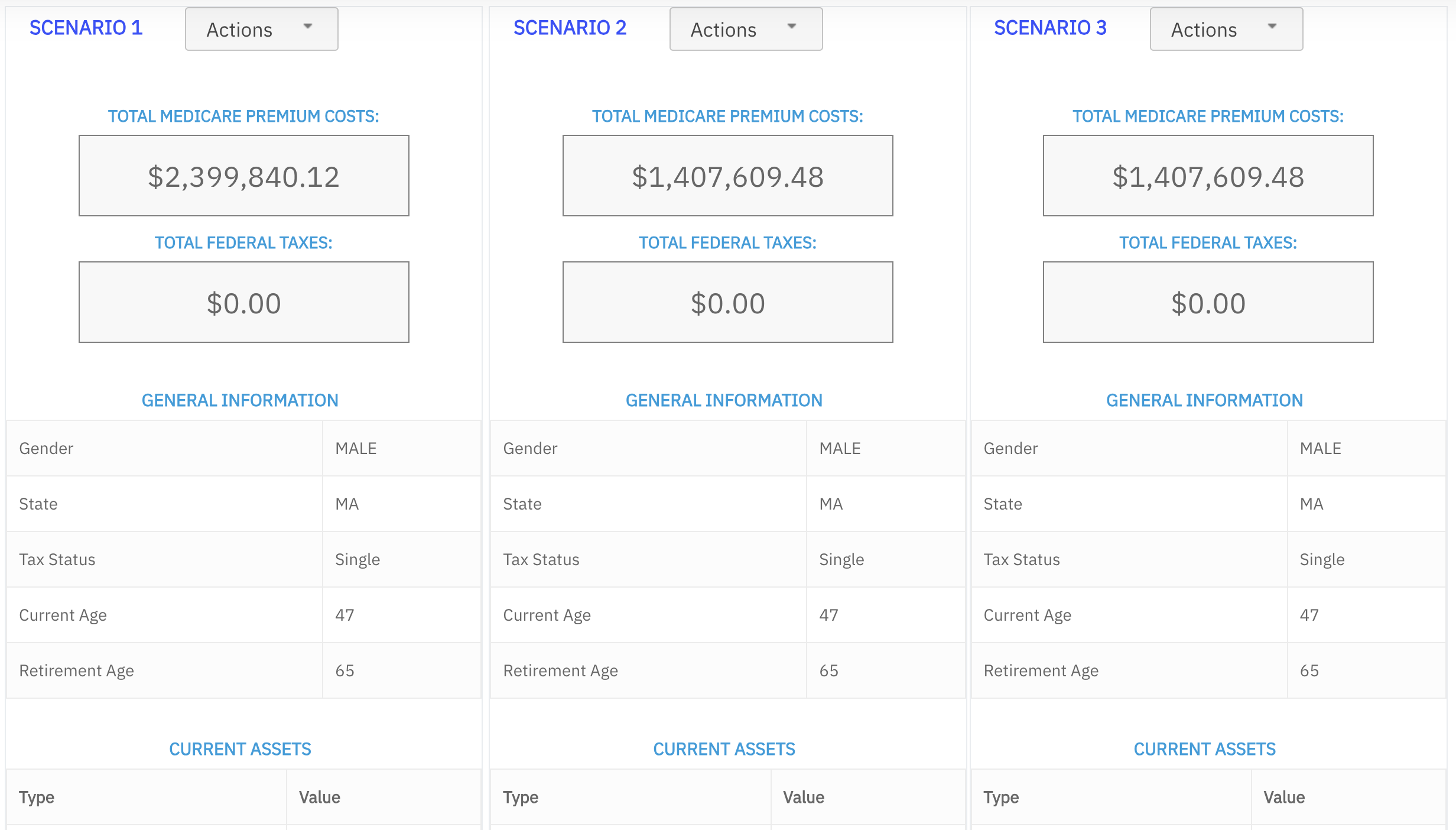

Source: www.healthcareretirementplanner.com

Source: www.healthcareretirementplanner.com

Medicare IRMAA 2024 What to Expect for Surcharges in the Coming Year, The centers for medicare services ( cms) is announcing the 2024 irmaa. What is irmaa for 2024?

Source: help.checkbook.org

Source: help.checkbook.org

IRMAA Related Monthly Adjustment Amounts Guide to Health, Policy for irmaa medicare part b and prescription drug coverage premiums sliding scale tables. The income limit for irmaa in 2024 is $103,000 for individuals and $206,000 for couples.

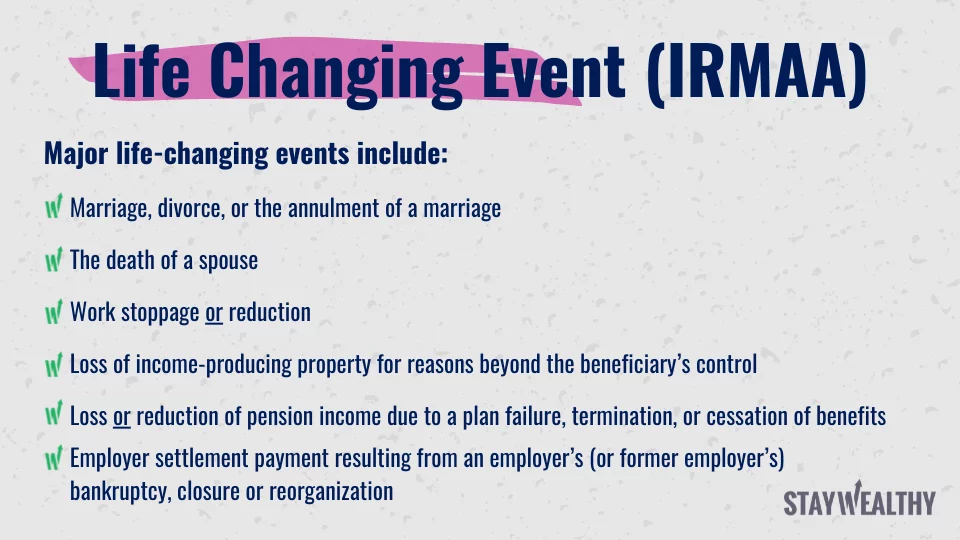

Source: youstaywealthy.com

Source: youstaywealthy.com

What Are the IRMAA 2024 Brackets (and How to Avoid It!), The 2024 irmaa brackets are, by law, going to increase, but the odds of you or someone you know reaching irmaa at some point are also increasing. Ago is above a ceratin amount, you will pay the standard premium amount plus irmaa which is an additional amount added to the standard premium.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

The IRMAA Brackets for 2024 Social Security Genius, For 2024, if your income is greater than $103,000. Here are the 2024 irmaa amounts for married taxpayers that file separately:

What are the 2024 Medicare Part B Premiums and IRMAA? Independent, For 2024, if your income is greater than $103,000. Here are the 2024 irmaa amounts for married taxpayers that file separately:

Source: financiallyspeaking.org

Source: financiallyspeaking.org

Hurricane IRMAA Financially Speaking, For example, you would qualify for irmaa in 2024 if your magi from your 2022 tax returns meets the 2024 income thresholds ($103,000 for. Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d premiums.

Source: www.healthcareretirementplanner.com

Source: www.healthcareretirementplanner.com

Medicare IRMAA 2024 What to Expect for Surcharges in the Coming Year, Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs. On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2024 premiums, deductibles, and coinsurance amounts for the medicare.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

The IRMAA Brackets for 2024 Social Security Genius, The answer to whether you will get to irmaa brackets in 2024 is all dependent on how much income you earned in 2022. Dan mcgrath november 24, 20235 min read.

Source: www.healthcareretirementplanner.com

Source: www.healthcareretirementplanner.com

Navigating the Medicare 2024 IRMAA Brackets [UPDATED PREMIUMS, For 2024, the irmaa thresholds again increased significantly, to $103,000 for a single person and $206,000 for a married couple. What are the 2024 irmaa brackets?

Source: gmiainc.com

Source: gmiainc.com

GMIA, Inc. 2023 Part B Costs and IRMAA Brackets, The 2024 irmaa brackets are, by law, going to increase, but the odds of you or someone you know reaching irmaa at some point are also increasing. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

In This Post, We’ll Delve Into What Irmaa Is, The Income Brackets For 2024, How The Premiums Are Calculated, Strategies For Managing Irmaa, And.

The irmaa income brackets for 2023 start at $97,000 ($103,000 in 2024) for a single person and $194,000 ($206,000 in 2024) for a married couple.

In 2024, You Can Earn Up To $22,320 Without Having Your Social Security Benefits Withheld.

Discover how medicare income limits 2024 will affect your premiums and what financial strategies can help manage costs effectively.