Minnesota Tax Increases 2024

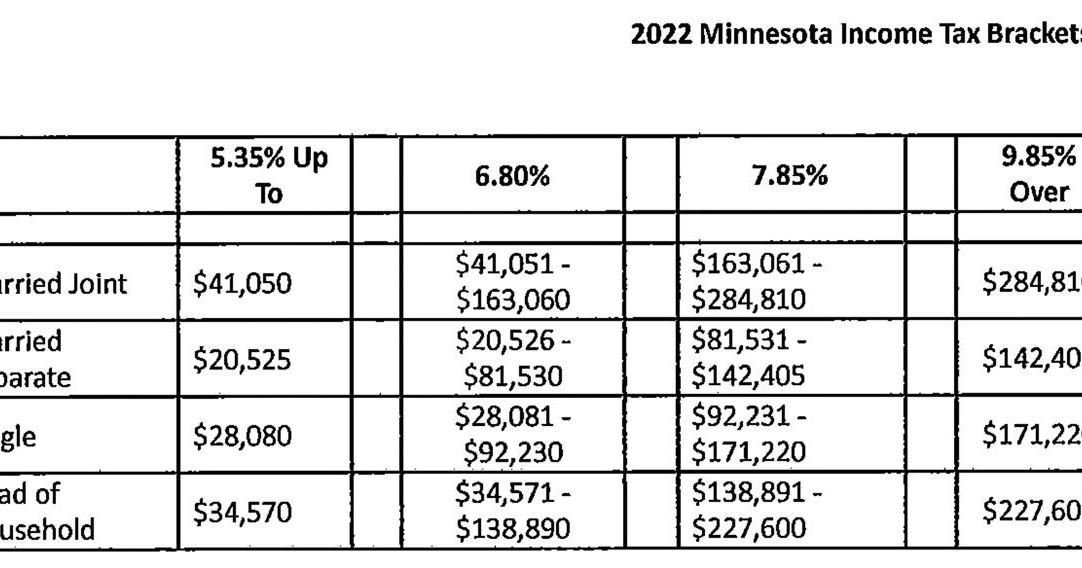

Minnesota Tax Increases 2024. These tables outline minnesota’s tax rates and brackets for tax year 2024. The minnesota tax bill signed into law on april 8, 2024, retroactively changed the effective date for the 70% net operating loss deduction limitation.

1) there are rebate checks, but not as big as the ones walz proposed. 1, 2024, increasing the rate from 1.25% to 1.54% of the manufacturer’s.

1) There Are Rebate Checks, But Not As Big As The Ones Walz Proposed.

Visit net operating losses for.

Two Sets Of Changes To The Minnesota Tax Code Last Year — One Aimed At High Earners And One At.

It now heads to gov.

The 2024 Tax Rates And Thresholds For Both The Minnesota State Tax Tables And Federal Tax Tables Are Comprehensively Integrated Into The Minnesota Tax Calculator For 2024.

Images References :

Source: www.walkermn.com

Source: www.walkermn.com

Minnesota tax brackets, standard deduction and dependent, What is in $3 billion tax deal made by minnesota democrats? Any minnesota city that didn’t receive permission for a sales tax increase will have to hold their plans until june 2025, when the new moratorium expires.

Source: patch.com

Source: patch.com

How To File Your 2023 Minnesota State Taxes Securely Minneapolis, MN, Vehicle registration tax changes will go into effect for the period starting on jan. 1, 2024, increasing the rate from 1.25% to 1.54% of the manufacturer’s.

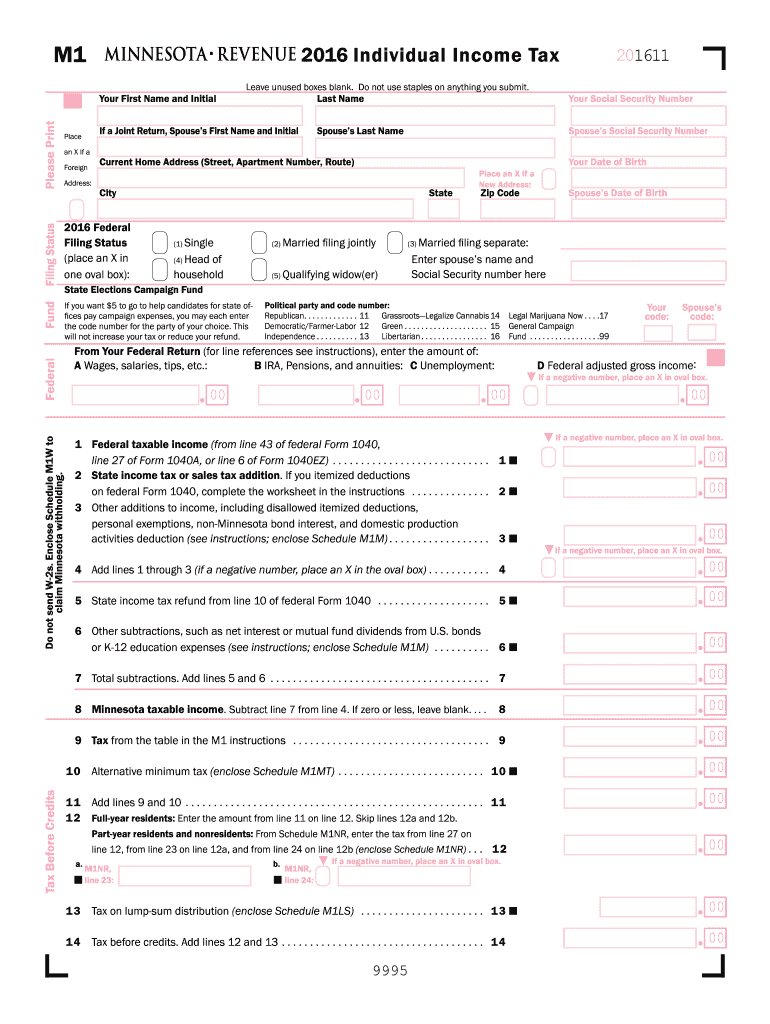

Source: www.dochub.com

Source: www.dochub.com

Minnesota state tax Fill out & sign online DocHub, If you pay estimated taxes, use this information to plan and pay taxes beginning in april 2024. The minnesota tax bill signed into law on april 8, 2024, retroactively changed the effective date for the 70% net operating loss deduction limitation.

Source: www.kare11.com

Source: www.kare11.com

While student loan won't be taxed federally, Minnesota, Vehicle registration tax changes will go into effect for the period starting on jan. Two sets of changes to the minnesota tax code last year — one aimed at high earners and one at.

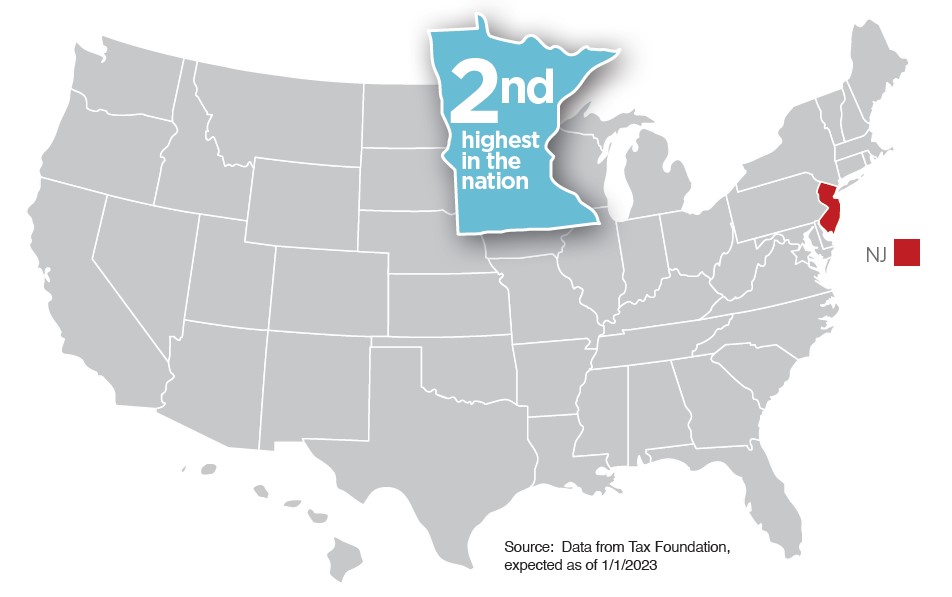

Source: www.mnchamber.com

Source: www.mnchamber.com

Minnesota’s unsustainable tax burden Minnesota Chamber of Commerce, (ap) — minnesota's budget outlook has improved thanks to higher corporate profits, officials said thursday as they projected a slightly bigger surplus. These tables outline minnesota’s tax rates and brackets for tax year 2024.

Source: itrfoundation.org

Source: itrfoundation.org

Spending, Debt, and Tax Increases Threaten Economy ITR Foundation, Visit net operating losses for. Minnesota’s ‘most progressive’ tax state designation explained.

Source: www.youtube.com

Source: www.youtube.com

What Tax Increases Might We Expect in 2022? YouTube, The 2024 legislative session started february 12. But getting ready for next year’s filing period is what the 2024 house tax bill is all about:

Source: printableformsfree.com

Source: printableformsfree.com

Minnesota State Tax Form 2023 Printable Forms Free Online, Draft bills working through the house contain at least $9.5 billion in tax and fee increases over the next four years, house republicans say. Minnesota’s hourly minimum wage will rise to $10.85 from $10.59 for large employers and to $8.85 from $8.63 for small employers effective jan.

Source: www.americanexperiment.org

Source: www.americanexperiment.org

Minnesota ranks 8th nationally for its reliance on taxes, 2024 minnesota sales tax changes. Two sets of changes to the minnesota tax code last year — one aimed at high earners and one at.

Source: www.dochub.com

Source: www.dochub.com

M1pr form 2022 Fill out & sign online DocHub, But getting ready for next year’s filing period is what the 2024 house tax bill is all about: The minnesota tax bill signed into law on april 8, 2024, retroactively changed the effective date for the 70% net operating loss deduction limitation.

The Minnesota Tax Bill Signed Into Law On April 8, 2024, Retroactively Changed The Effective Date For The 70% Net Operating Loss Deduction Limitation.

The department will release final property tax levy information in february.

It Now Heads To Gov.

But getting ready for next year’s filing period is what the 2024 house tax bill is all about: